- VA loans offer no down payment, no PMI and low rates, making them a strong option for eligible buyers.

- Be aware of the VA funding fee and primary residence requirement before applying.

- For most Veterans, the advantages outweigh the drawbacks compared to conventional options.

VA loans are often one of the most attractive home financing options for Veterans and military borrowers. FY 2025 marked another strong year for the VA loan program, with the VA guaranteeing over 525,000 loans and purchase loan volume increasing by more than 25% compared to FY 2024. Refinancing also surged, with VA Streamline refinances (IRRRLs) more than doubling year-over-year. However, the VA loan isn't always the best financial choice for every borrower.

Here we dive into the pros and cons of the VA loan program and the most significant financial considerations to keep in mind when choosing your mortgage.

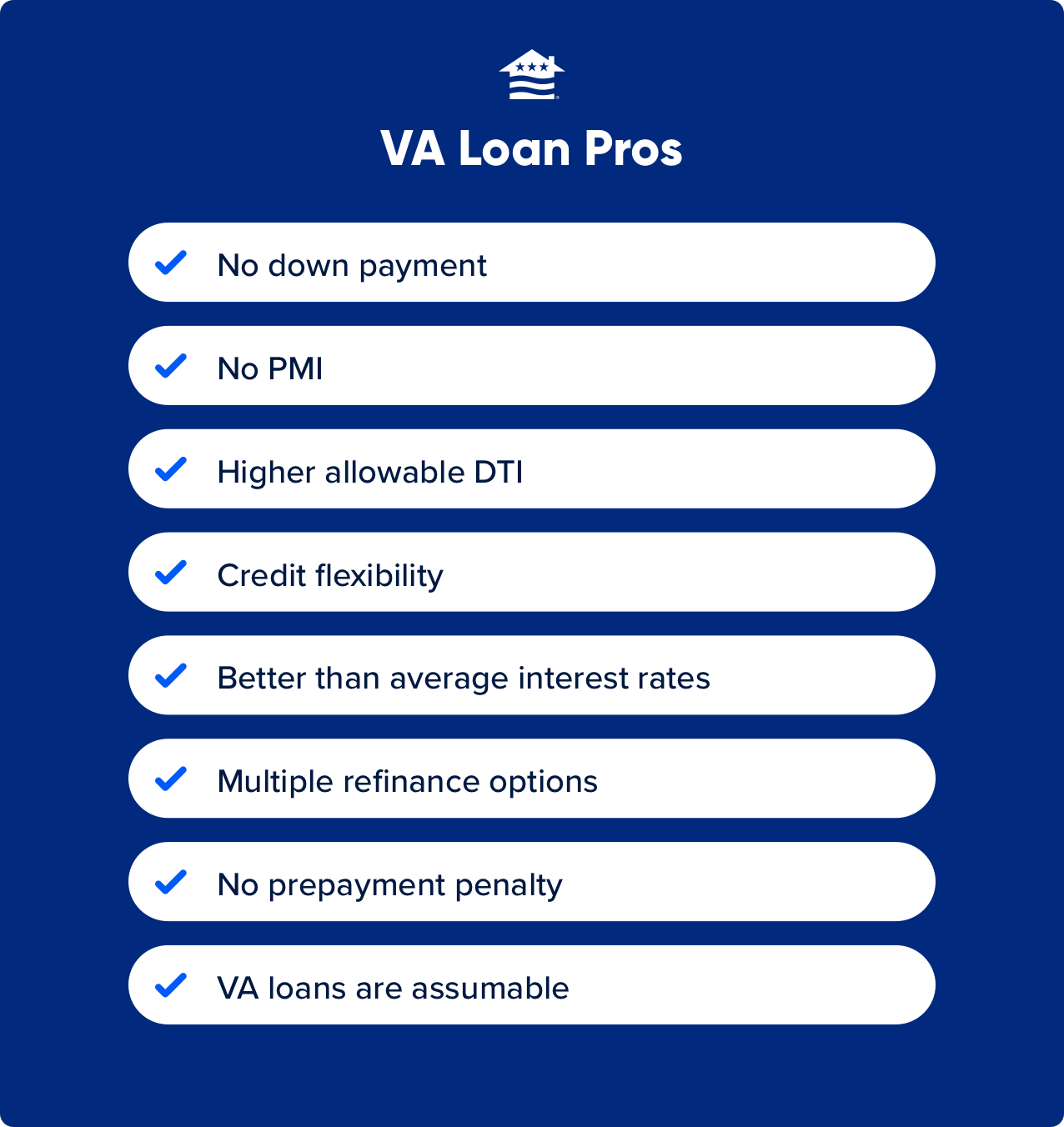

VA Loan Pros and Cons at a Glance

| Pro | Con |

|---|---|

| No down payment | VA Funding Fee |

| No PMI | VA Funding Fee increases after first use |

| Higher allowable DTI | Loan could exceed market value |

| Credit flexibility | Only for primary residences |

| Better than average interest rates | Sellers and agents may not be familiar |

| Multiple refinance options | - |

| No prepayment penalty | - |

| VA loans are assumable | - |

What are the Pros of a VA Loan?

Starting with the pros, here are some of the more prominent advantages of the VA home loan program:

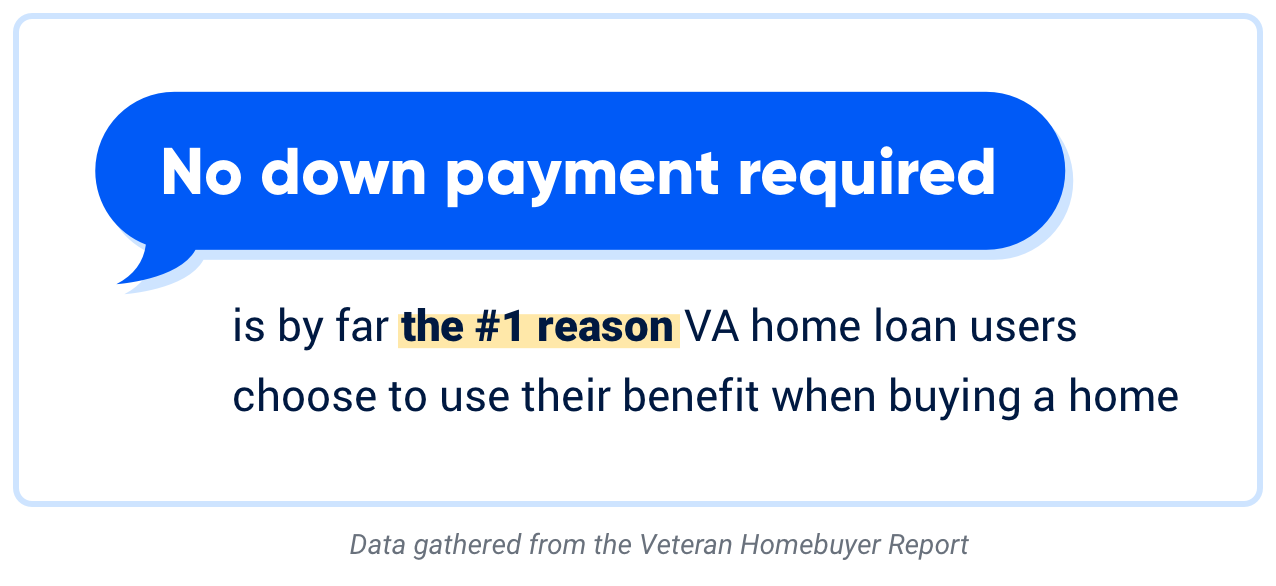

No Down Payment

The ability to put $0 down is one of the biggest pros of VA loans. Qualified borrowers can borrow as much as a lender is willing to lend, all without needing a down payment.

FHA loans typically require a 3.5% minimum down payment, and for many conventional loans, it's a 5% minimum. On a $175,000 home purchase, that's a $6,125 down payment for FHA and $8,750 for conventional.

While this is a pro for many who can't afford a down payment, it could also be considered a con for some borrowers. It's possible to finance more than the home's value, which means you could start out with no equity in your home.

No Private Mortgage Insurance (PMI)

Private mortgage insurance, or PMI, is typically required for conventional borrowers who don’t have a 20% down payment at closing. No matter what you put down, VA loans do not have PMI, which can save Veterans thousands.

FHA borrowers have a form of PMI known as a Mortgage Insurance Premium (MIP) that typically spans the life of the loan. They also have an upfront fee due at closing.

Higher Allowable Debt-to-Income (DTI) Ratio

Lenders will look at the ratio of your gross monthly income to your major monthly debts. The VA typically wants to see a debt-to-income ratio of 41% or less, but it’s possible to exceed that benchmark and still secure VA financing.

No Prepayment Penalty

VA loans have no prepayment penalties. You can pay off your mortgage early or make additional payments without fear of being penalized financially.

Other loan products on the market, such as conventional and FHA, may have prepayment penalties, which can prevent borrowers from saving money.

Refinance Options

The VA home loan program has a pair of refinance loans that can help qualified buyers lower their monthly payments or get cash back from their equity.

The largest benefit is to current VA borrowers who want to lower their rate through a VA Streamline refinance, also known as the VA Interest Rate Reduction Refinance Loan (IRRRL). IRRRLs allow Veterans to more easily lower their rate since you're refinancing from one VA product to another.

The VA Cash-Out refinance allows VA and non-VA homeowners to refinance and get cash at closing to pay down debt or take care of other needs. Keep in mind that refinancing may result in higher finance charges over the life of the loan.

Flexibility With Bankruptcy and Foreclosure

Some borrowers who qualify can be eligible for a VA home loan two years after a Chapter 7 bankruptcy, short sale, or foreclosure. The wait can be much longer for different loan types.

The VA also encourages lenders to offer foreclosure avoidance programs. The goal of VA loans isn’t only to get Veterans in homes but to keep them there.

The VA Amendment to Contract

Purchase contracts typically come with appraisal contingencies. The VA Amendment to Contract allows would-be buyers to walk away from a home if the VA appraisal comes back low.

In this scenario, the buyer would automatically receive their earnest money back and be free to walk away from the deal. Unlike other loan types, VA buyers cannot waive this appraisal contingency.

VA Loans are Assumable

Assumptions have traditionally been a lesser-known and lesser-used pro of the VA home loan. The biggest benefit of assumptions is that borrowers can take over a Veteran’s loan and lock into interest rates lower than what is currently available. Looking into a VA loan assumption might be a huge win financially, especially once interest rates start to rise.

However, assumptions aren't for everyone. If another borrower assumes your VA loan, your entitlement may be wrapped up in that loan until the loan is refinanced or paid in full — unless the homebuyer assuming the VA loan is a Veteran and transfers their entitlement.

Better Terms and Interest Rates

VA loans have had the lowest average fixed rate on the market for more than six years running, according to data from Ellie Mae. Housing data also show that VA loans typically feature lower closing costs and fees than conventional mortgages.

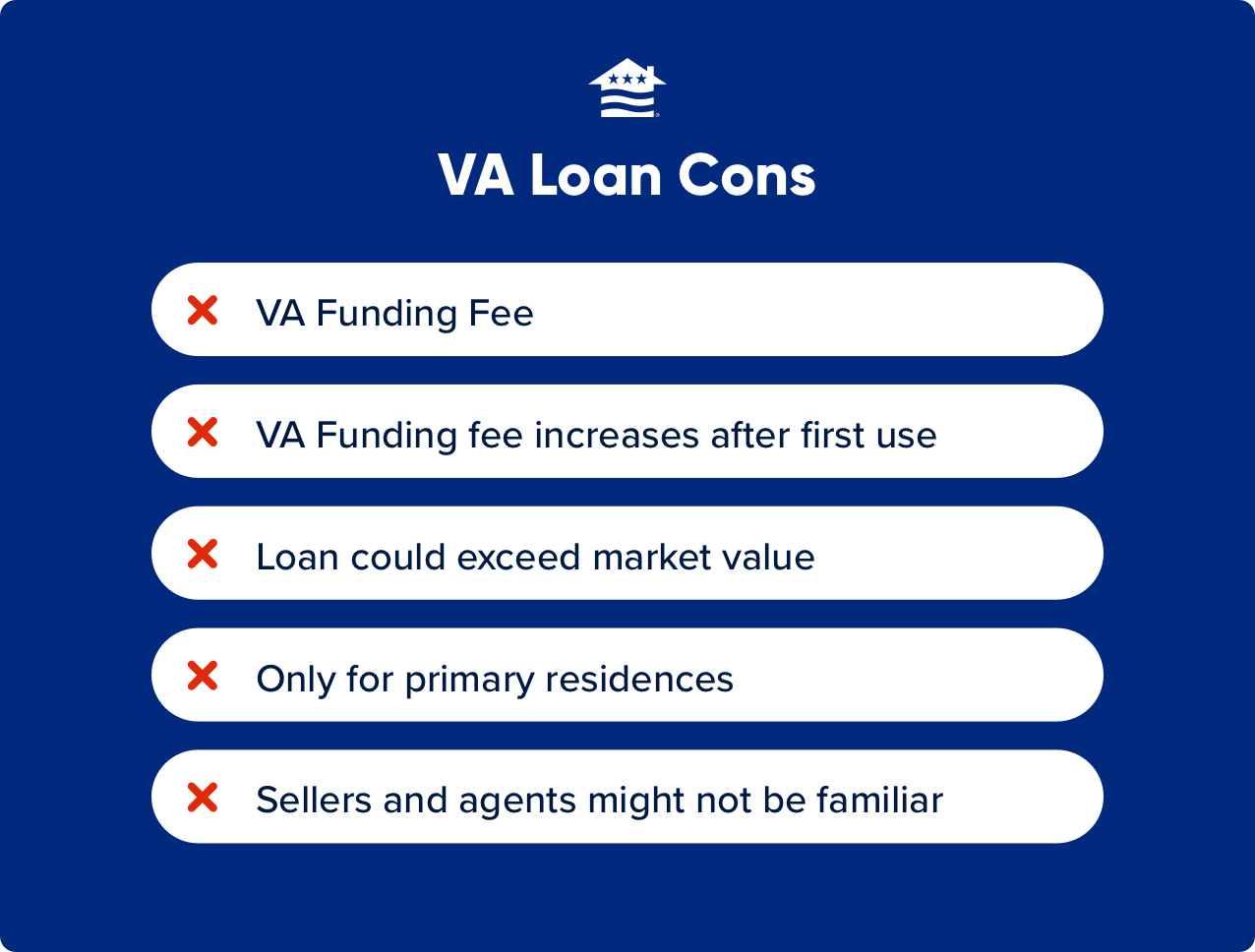

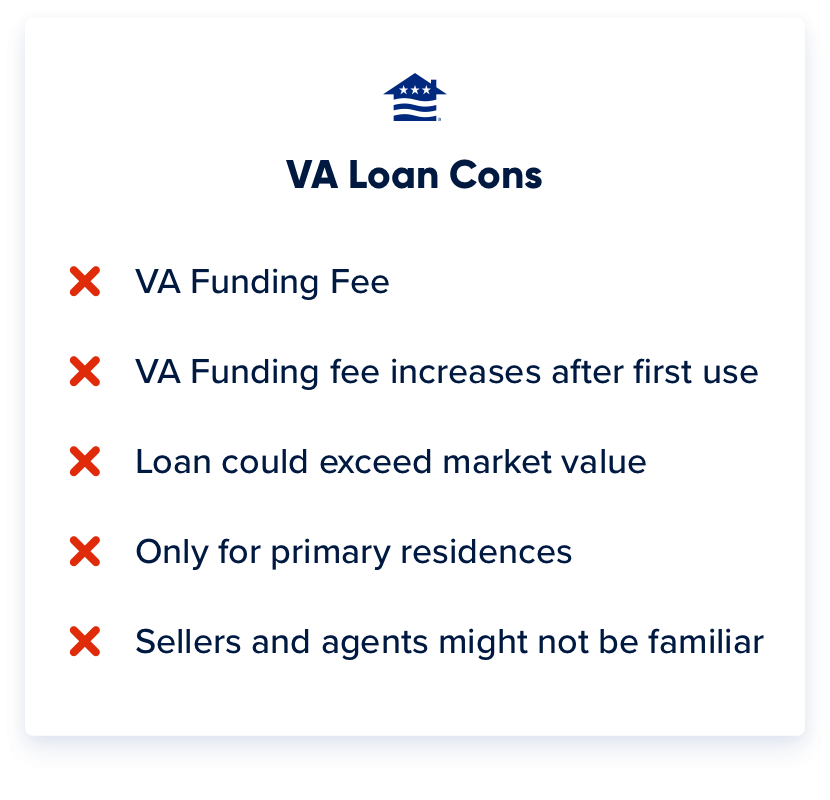

What are the Cons of a VA Loan?

VA loans do come with some potential disadvantages. Let’s take a look at some of the larger potential cons of the program:

VA Funding Fee

Most VA borrowers must pay the VA Funding Fee. The VA Funding Fee is a mandatory fee charged by the VA to help keep the program running for future generations.

The good news is you can finance this into the loan, and borrowers with service-connected disabilities, have a Purple Heart or are a surviving military spouse are exempt from paying the fee.

The Funding Fee Increases on Subsequent Use

Veterans looking to reuse their VA loan benefit will find that the VA Funding Fee is higher than the first time. The first-time use fee is lower than the fee for all subsequent uses for most VA loans. Buyers can lower this fee if they make a down payment.

They're Intended for Primary Residences

The VA loan isn't a loan program you can use to purchase a second home or an investment property. They’re intended for primary residences only, and the borrower must intend to live in it full-time. Because of this, there are occupancy requirements set by the VA. The only exception here is with the VA streamline refinance.

Not All Real Estate Agents are Familiar With the VA Loan

Working with a real estate agent familiar with the VA loan product is crucial to ensuring a smooth homebuying process.

Unfortunately, not every real estate agent is experienced with the program, which can result in wasted time if the property doesn’t meet the VA’s appraisal requirements or other guidelines.

Get connected with an agent specializing in VA borrowers through our affiliate realty network, Veterans United Realty.

Sellers aren't Always on Board

Sellers may not be open to VA offers in a highly competitive housing market. It's not an extremely common occurrence but can happen when multiple offers are on the table.

This typically has much to do with the lack of understanding or myths and misconceptions surrounding VA loans.

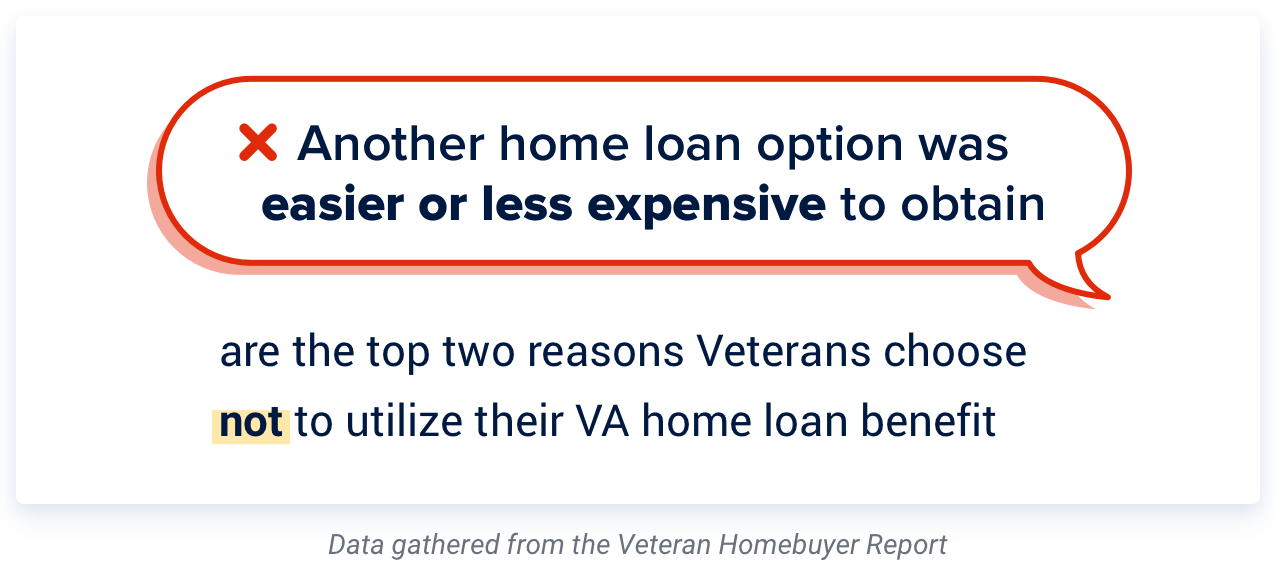

So, are VA Loans Good?

VA loans are typically the best option for VA homebuyers. However, it all depends on your unique financial situation.

If you're unsure of the best option for you, contact Veterans United. We can answer your questions about the VA loan and help you compare loan types to make the best financial decision.

How We Maintain Content Accuracy

Our mortgage experts continuously track industry trends, regulatory changes, and market conditions to keep our information accurate and relevant. We update our articles whenever new insights or updates become available to help you make informed homebuying and selling decisions.

Current Version

Dec 16, 2025

Written ByChris Birk

Reviewed ByDon Wilson

Added new VA loan data for the 2025 fiscal year for market context.

Jun 2, 2025

Written ByChris Birk

Reviewed ByDon Wilson

Incorporated expert insight about VA loan misconceptions from Loan Officer Development team.

Jan 22, 2025

Written ByChris Birk

Reviewed ByDon Wilson

Content fact checked and reviewed by underwriter Don Wilson.

Veterans United often cites authoritative third-party sources to provide context, verify claims, and ensure accuracy in our content. Our commitment to delivering clear, factual, and unbiased information guides every piece we publish. Learn more about our editorial standards and how we work to serve Veterans and military families with trust and transparency.

Related Posts

-

VA Renovation Loans for Home ImprovementVA rehab and renovation loans are the VA's answer to an aging housing market in the United States. Here we dive into this unique loan type and the potential downsides accompanying them.

VA Renovation Loans for Home ImprovementVA rehab and renovation loans are the VA's answer to an aging housing market in the United States. Here we dive into this unique loan type and the potential downsides accompanying them. -

How to Get a VA Loan as a Reserve or National Guard MemberNational Guard and Reserve members can also get a VA home loan. Learn more about eligibility, income standards, required documentation, and more.

How to Get a VA Loan as a Reserve or National Guard MemberNational Guard and Reserve members can also get a VA home loan. Learn more about eligibility, income standards, required documentation, and more.