The Veterans United survey also found that 93% of Veterans and service members used a VA loan to buy their first home.

Celebrating its 80th anniversary on June 22, the VA loan benefit continues to fulfill its original mission to expand access to homeownership and help younger Veterans build stronger financial futures.

A new survey from Veterans United Home Loans to commemorate the milestone found that 93% of Veterans and service members used a VA loan to buy their first home. At the same time, 8-in-10 Veterans were 34 years old or younger the first time they used their home loan benefit.

The 0% down loan program has experienced a resurgence since the Great Recession and is nearing its 30 millionth loan guarantee. A vital part of the national housing economy, VA loans have also emerged as the top VA benefit among Veterans and service members, according to the survey.

“The survey findings underscore the profound impact of the VA loan program on Veterans and service members, particularly younger generations,” said Chris Birk, vice president of mortgage insight at Veterans United. "Eight decades later, this hard-earned benefit continues to help break down barriers to homeownership and provide a solid foundation for financial stability and growth.”

Big for First-Time Buyers

VA loans help qualified Veterans and service members purchase homes without the need for a down payment or great credit. They also feature the industry’s lowest average interest rates.

Historically about 2% of the mortgage market, VA loans surged in the wake of the housing crisis. Today, they account for about 10-12% of the market. For decades, this benefit has removed homebuying barriers and helped Veterans and military families plant roots and build generational wealth.

Today, more than half of VA purchase loans go to Millennial and Generation Z Veterans and service members. Many of them wouldn’t have been able to become homeowners without their home loan benefit.

“For generations, VA loans have been a game-changer for younger homebuyers, helping millions of Veterans and active duty military get their first homes, start building equity and ultimately creating a stronger financial future,” Birk said.

“The high satisfaction rates and widespread use among first-time homebuyers highlight the benefit’s effectiveness in fostering homeownership and financial security,” Birk said. helping build generational wealth first-time and younger homebuyers, providing access to homeownership without the need for a down payment or exceptional credit,"

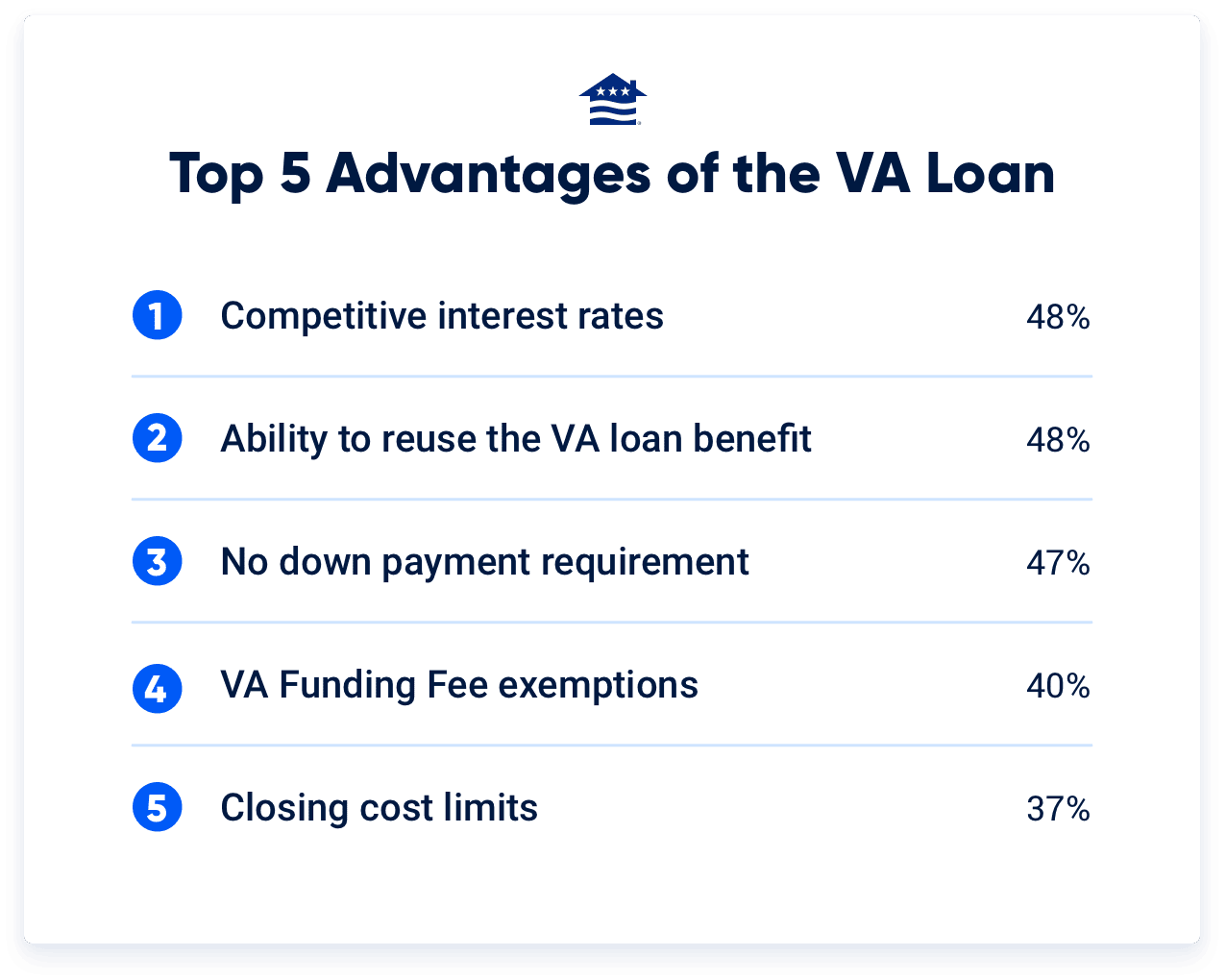

Here’s what Veterans and service members say are the top five advantages of VA loans:

The VA Funding Fee is a governmental fee applied to every VA loan. Veterans receiving compensation for a service-connected disability and select others are exempt from the fee.

In all, 90% of Veterans said their VA loan benefit makes buying a home affordable.

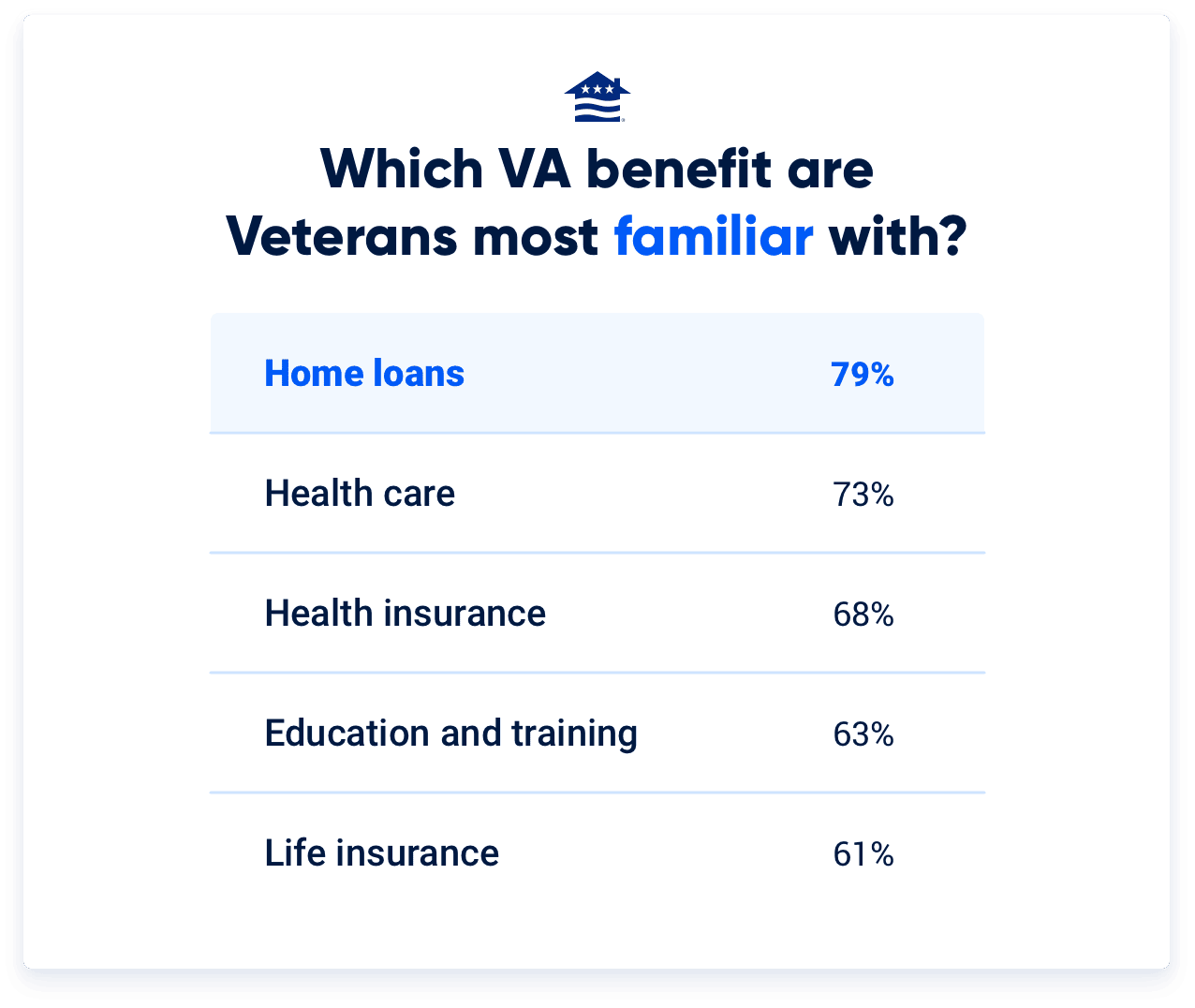

Top in Benefit Satisfaction & Knowledge

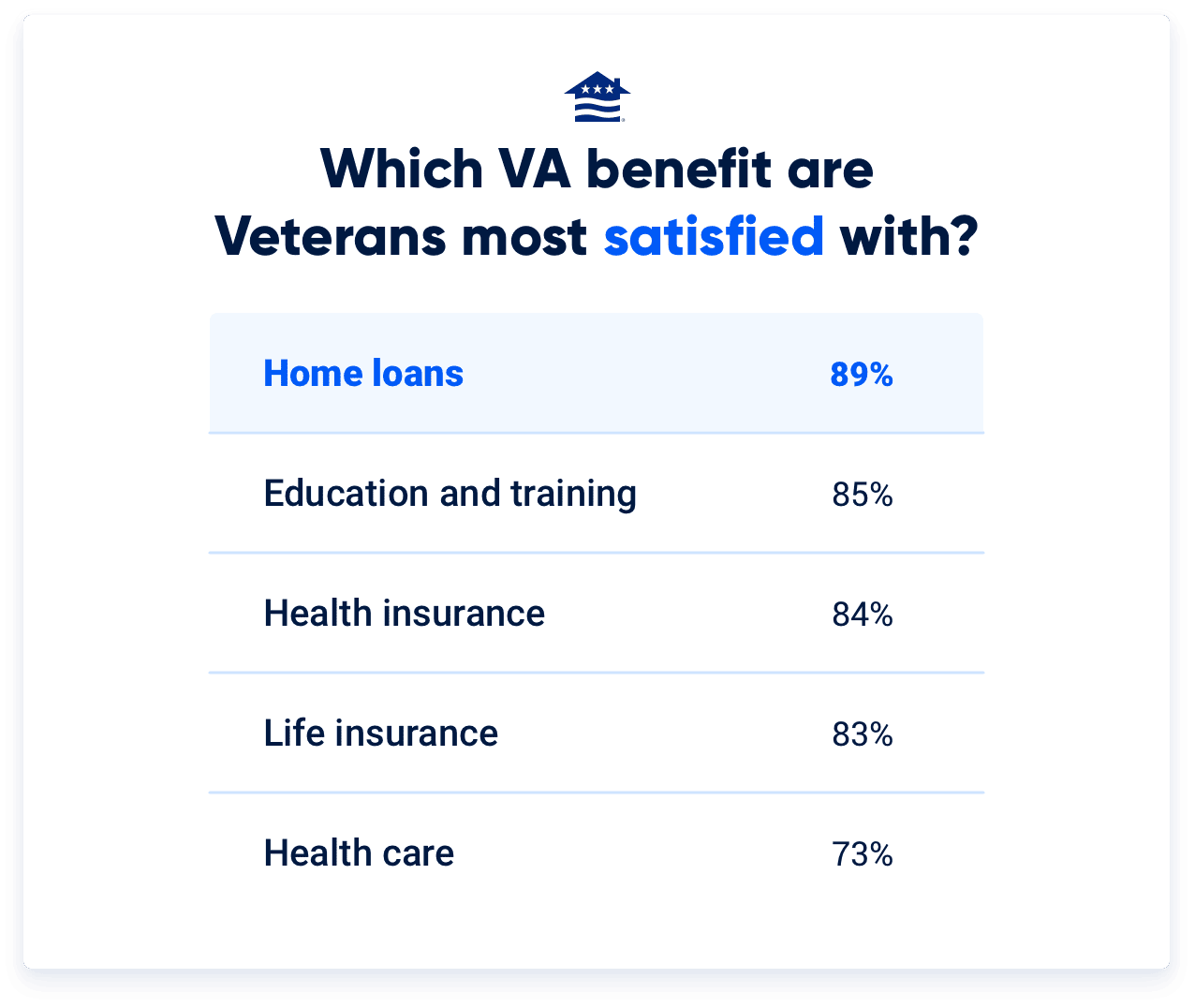

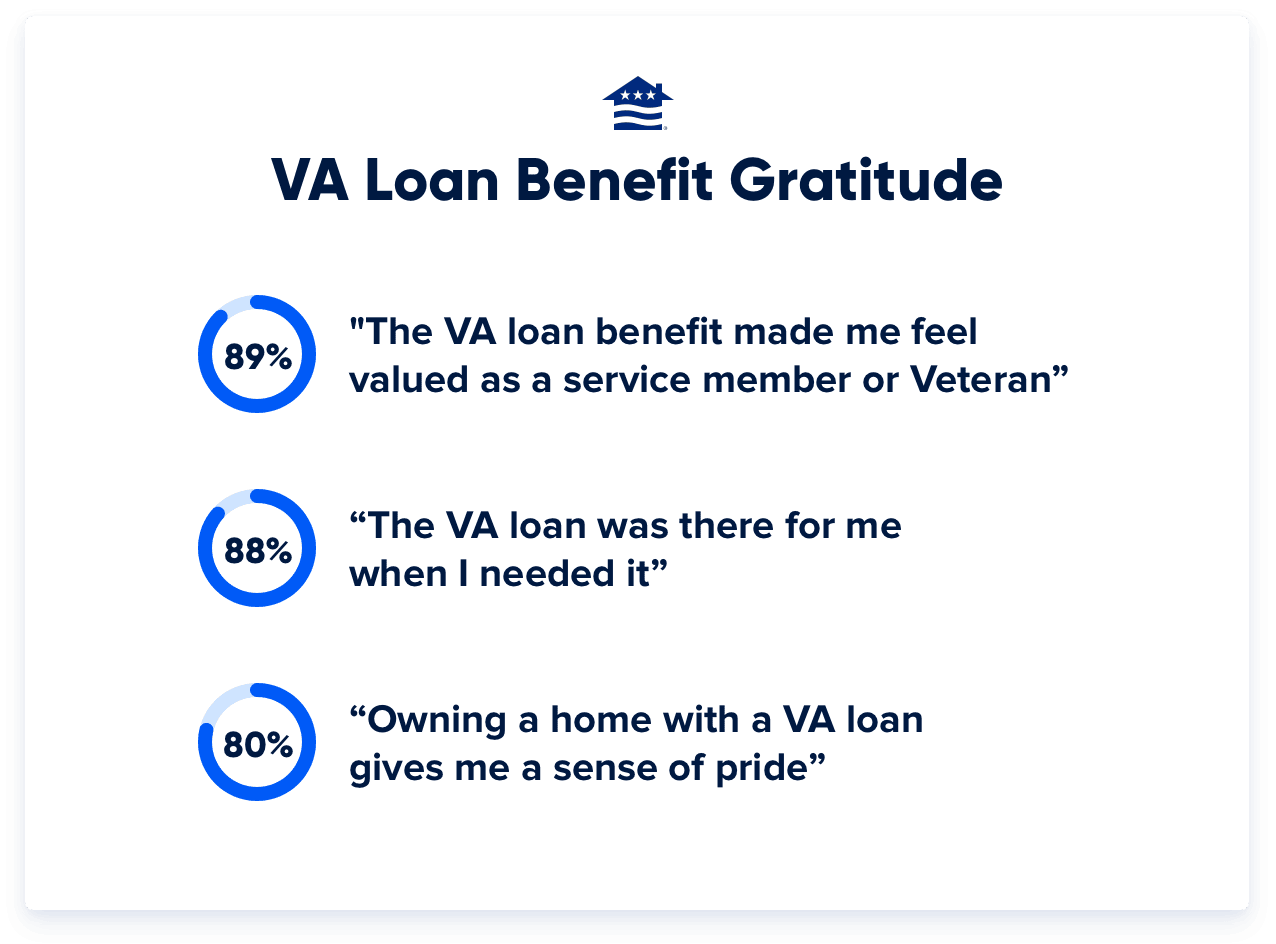

Veterans and service members earn access to a range of benefits, from education and health care to insurance and more. The home loan benefit ranks first among Veterans and service members in terms of both satisfaction and knowledge.

Most Veterans and service members also feel a deep sense of pride related to the home loan benefit. The VA loan is one of the signature benefits of the original GI Bill of Rights, and its core mission has changed little since its creation.

“The VA helped me get a home,” one survey respondent said. “I would not have been able to do it under normal circumstances.”

Another survey respondent said: “We were in a position where we wouldn’t be able to afford a home. The VA loan has helped my family accomplish everything we were set out to do.”

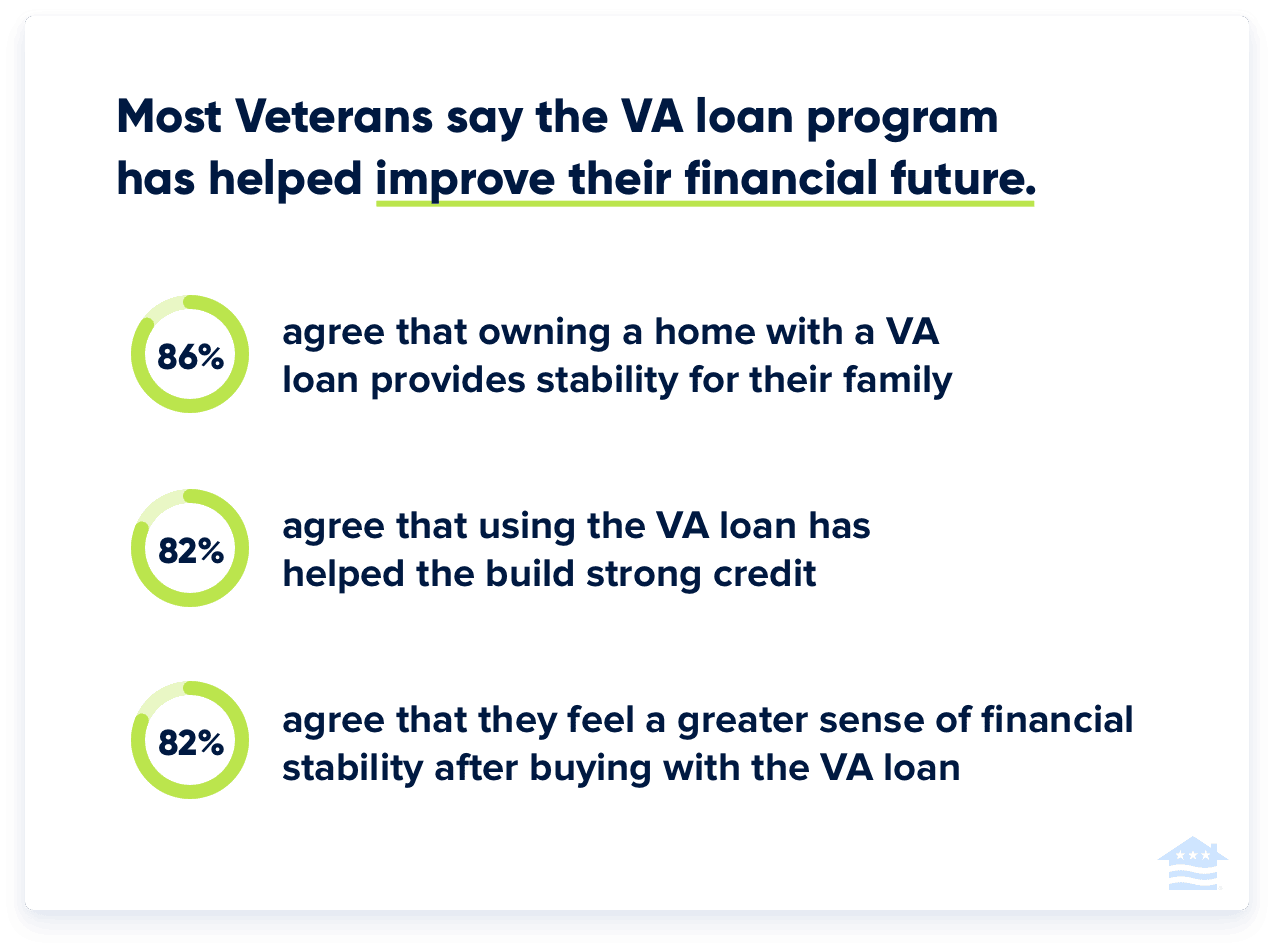

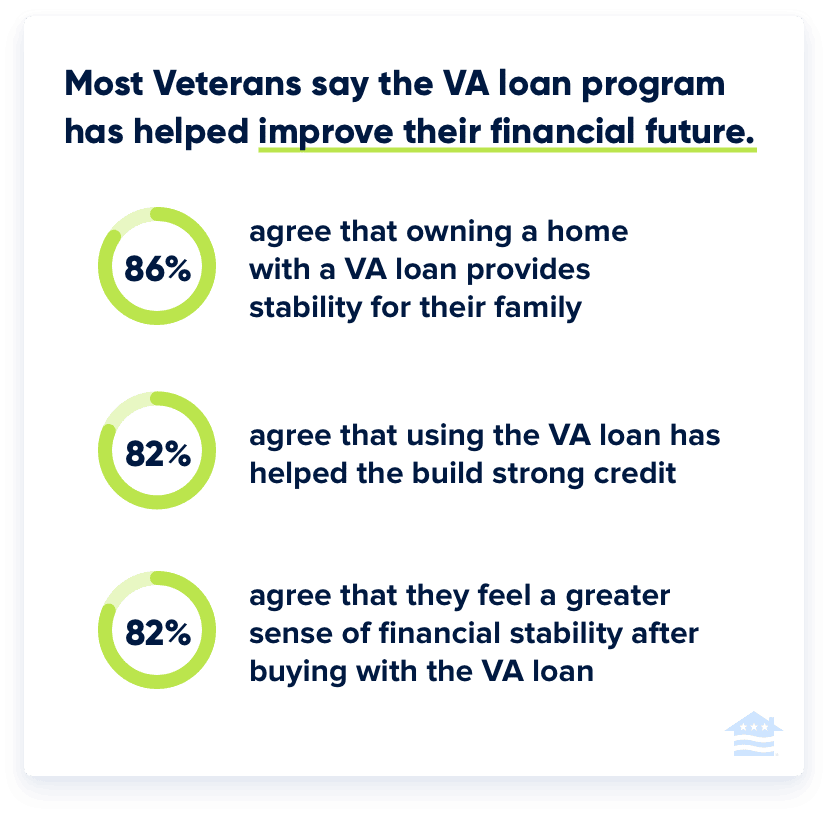

Stronger Financial Future

Most Veterans say the VA loan program has helped improve their financial future.

Here’s a sampling of some of the comments survey respondents provided:

“The VA loan benefit helped me buy a home when I didn’t think it was possible and for that I am forever thankful.”

“The VA loan benefit enabled me to purchase my own home, leading to substantial savings and significantly enhancing my quality of life. It allowed me to fulfill my dream of having a large family by making homeownership affordable.”

“Without access to the VA loan, my family and I would not have been able to purchase our first home at such a young age. This enabled us to develop a higher net worth that we would not have been able to achieve so quickly.”

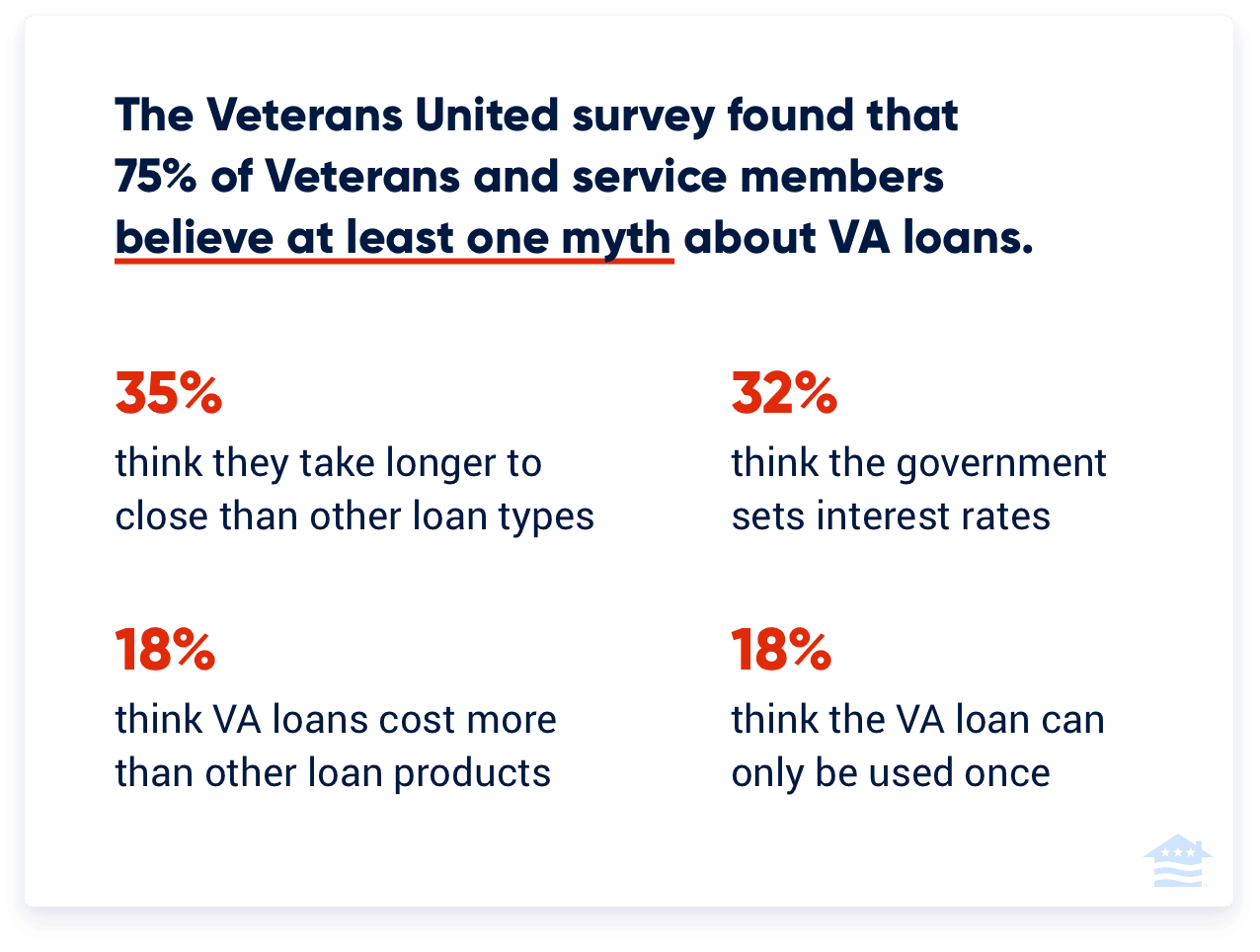

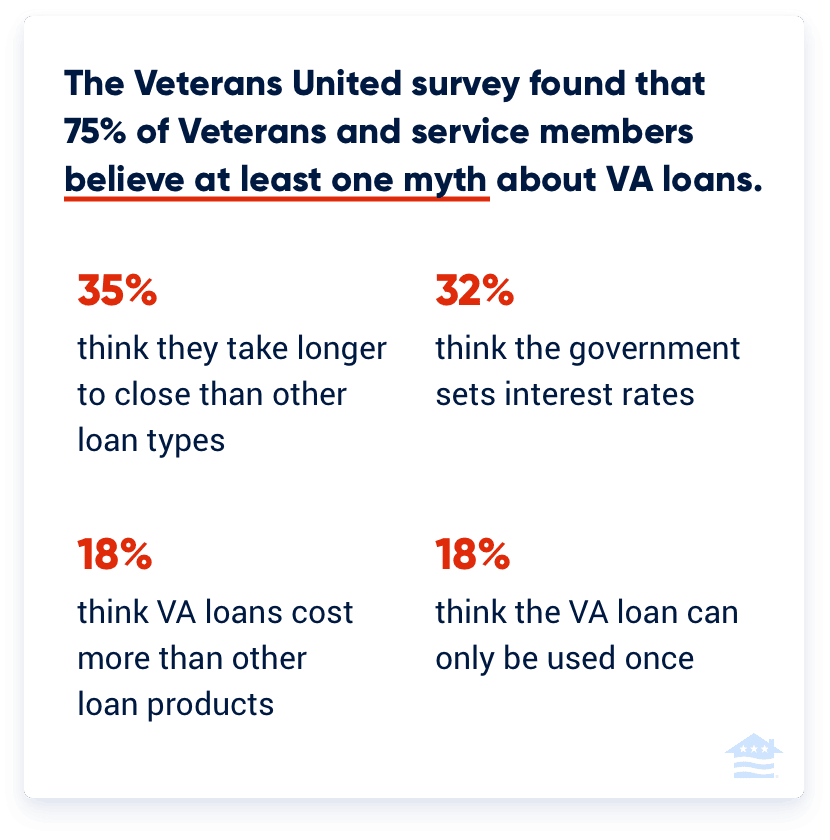

Misconceptions and Challenges

Despite the incredible growth of the VA loan over the last 15 years, misconceptions and challenges persist that keep some Veterans from using or even considering their home loan benefit.

Some misconceptions reflect the need for more VA loan and mortgage education for Veterans and service members.

The Veterans United survey found that 75% of Veterans and service members believe at least one myth about VA loans:

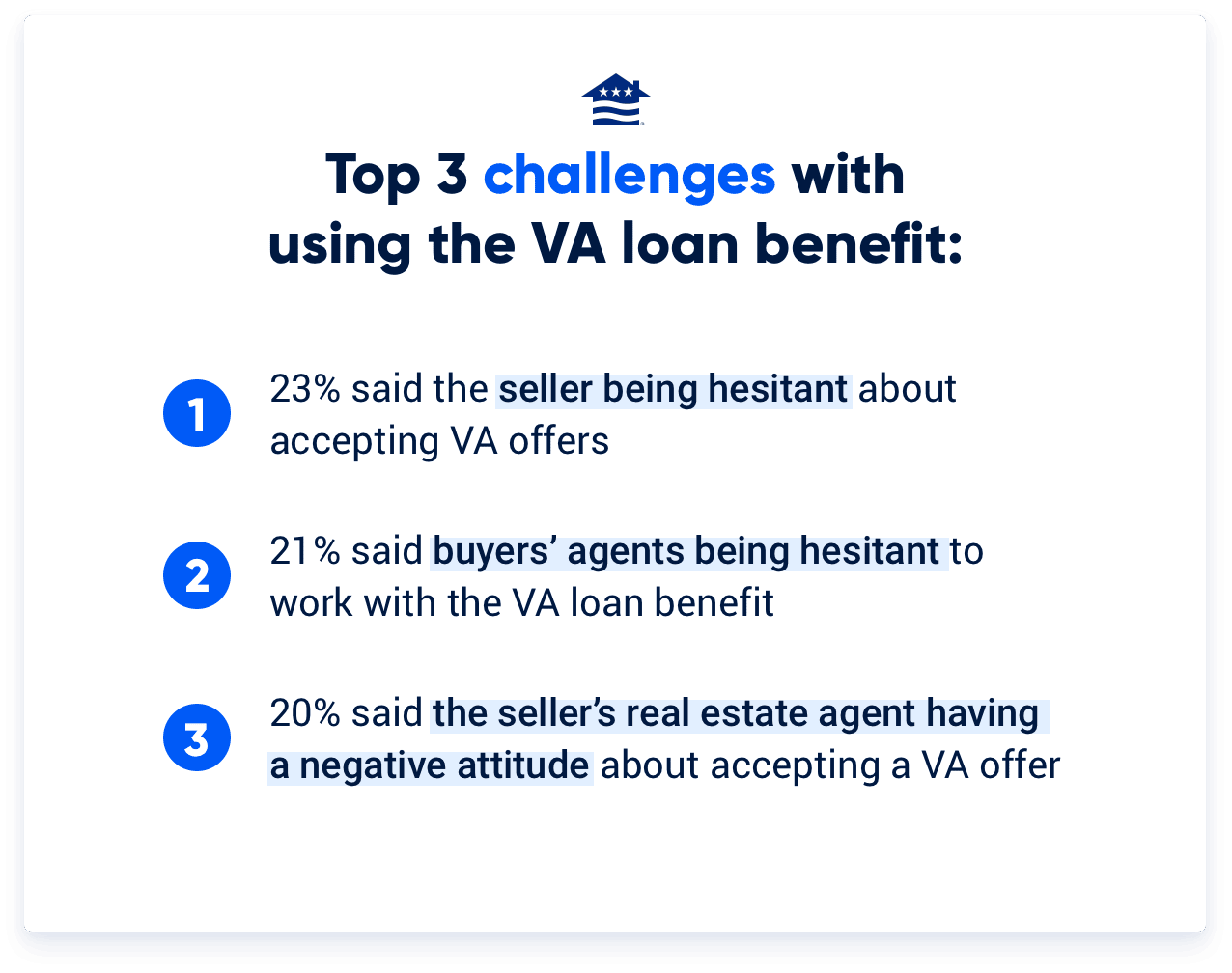

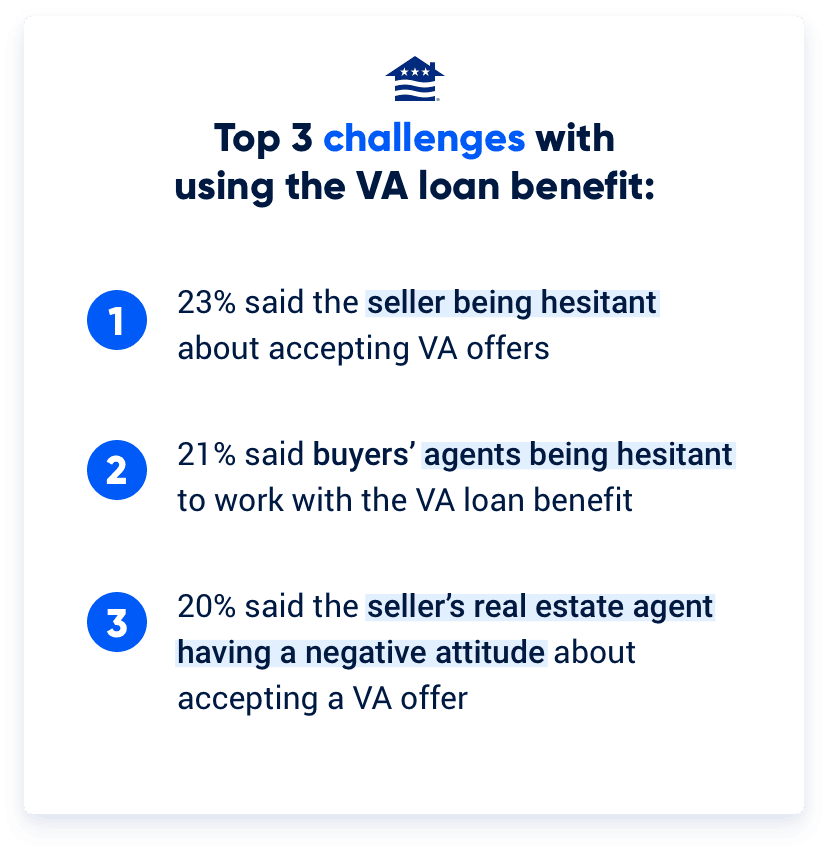

Other challenges and improvement areas highlight the outsized role that real estate agents and home sellers can play when it comes to whether Veterans can compete with their earned benefit.

"Despite the tremendous success and growth of the VA loan program, many Veterans and service members still face misconceptions and challenges when using their benefit," Birk said. "It's crucial to address the myths and biases surrounding VA loans, especially among home sellers and real estate agents, to ensure our Veterans can fully leverage the advantages they’ve earned. Education and awareness are key to overcoming these obstacles and making homeownership more accessible for all who have served."

Loan Program Nears 30 Million Loans

The VA loan program nears its 80th anniversary on the cusp of guaranteeing its 30 millionth home loan. This critical benefit has helped generations of Veterans and military families build wealth while in many ways shaping the American middle class.

VA loans are also helping to shift the national conversation when it comes to the security and value of low- and no-down payment mortgages. VA loans have had the lowest foreclosure rate on the market for most of the last 15 years, despite the fact that about 8-in-10 buyers purchase without a down payment.

“Today, his historic benefit is still making good on its promise to level the playing field and help those who serve achieve the dream of homeownership,” Birk said. "Beyond that, VA loans are also helping to shape the future of homebuying in this country by demonstrating the viability and success of low- and no-down payment mortgages. This benefit continues to open doors and build financial stability for those who have served our nation.”

Methodology

On behalf of Veterans United, data and research firm Sparketing conducted an online survey of 500 Veterans and service members who have used the VA loan benefit from April 1-11, 2024.

We surveyed service members from both the active and Reserve components, as well as Veterans.

For the purpose of this survey, active duty military are full-time members of the Armed Forces. The Reserve component includes drilling National Guardsmen and Reservists. Veterans are military members who have been discharged or retired from the service and no longer serve in uniform.

Related Posts

-

How to Make an Offer on a HouseOnce you’ve found the right home, you need to know how to put together a purchase offer. Learn tips for putting an offer on a house with a VA loan.

How to Make an Offer on a HouseOnce you’ve found the right home, you need to know how to put together a purchase offer. Learn tips for putting an offer on a house with a VA loan. -

4 Tax Breaks for Homeowners for 2025Owning a home not only offers a sense of security but can also lead to significant tax savings. Discover the top tax deductions and credits available to homeowners so you can enjoy the perks of homeownership – even at tax time.

4 Tax Breaks for Homeowners for 2025Owning a home not only offers a sense of security but can also lead to significant tax savings. Discover the top tax deductions and credits available to homeowners so you can enjoy the perks of homeownership – even at tax time.